Trading Terminal

LiveProfessional Trading Dashboard

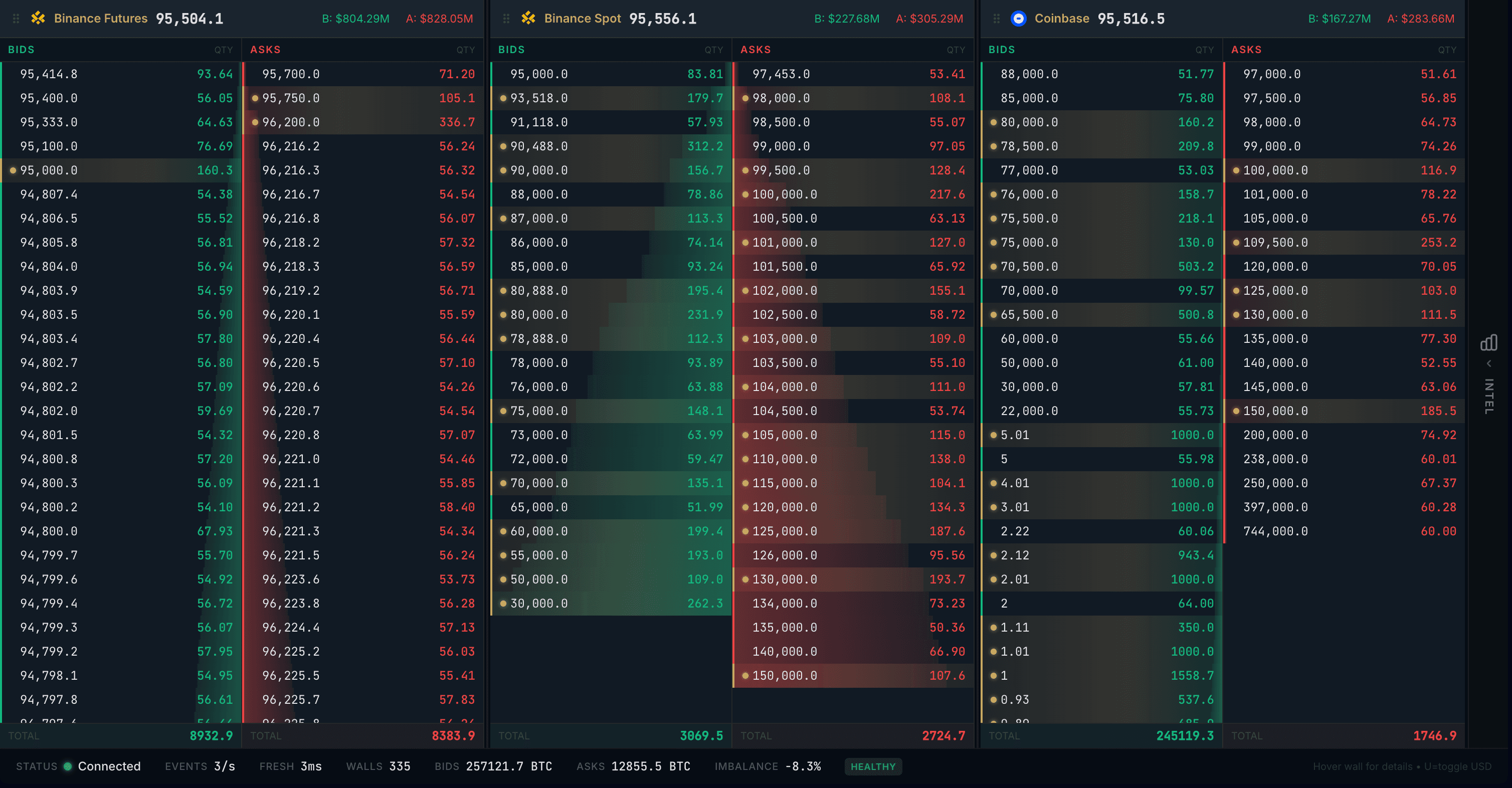

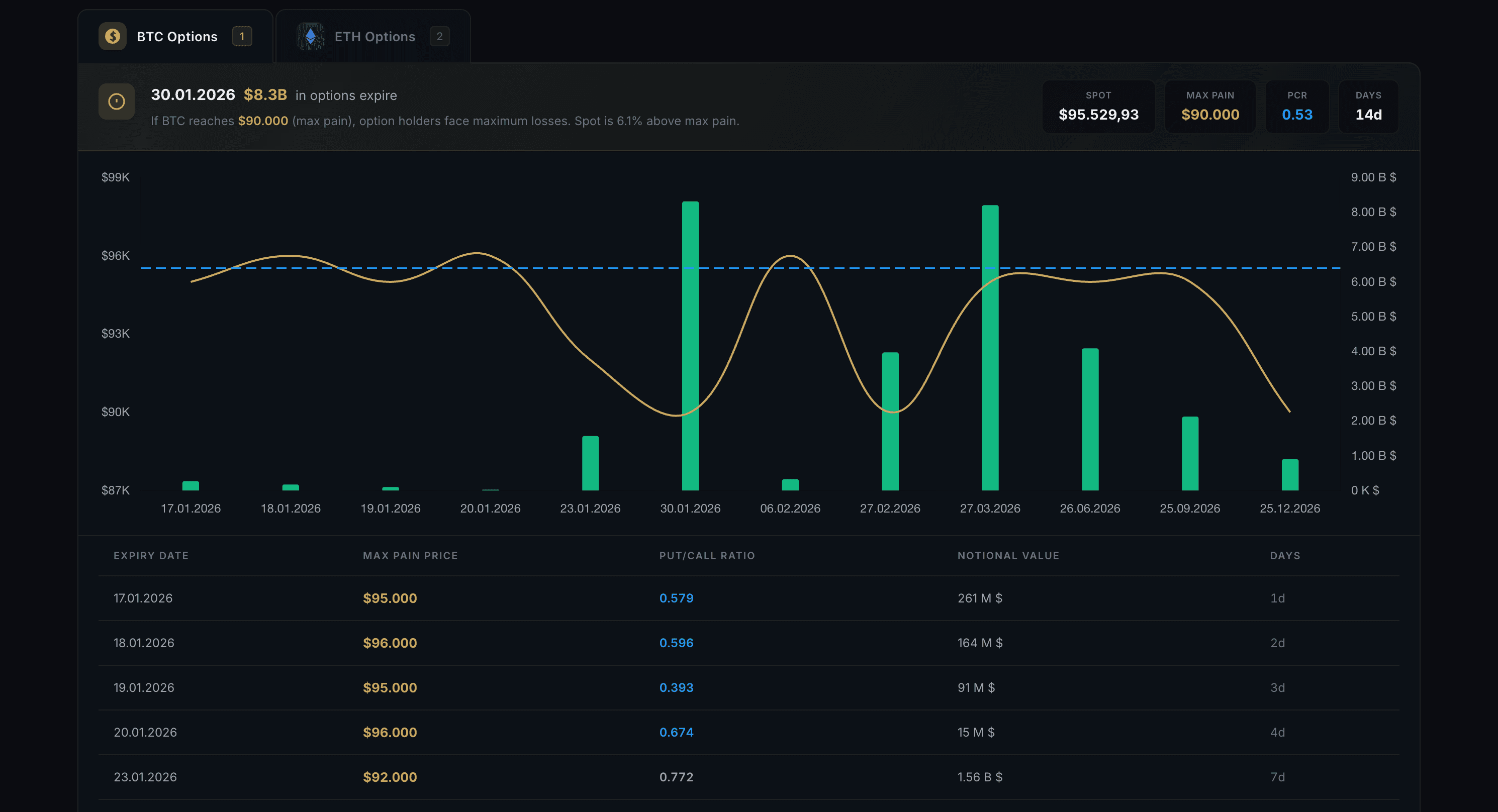

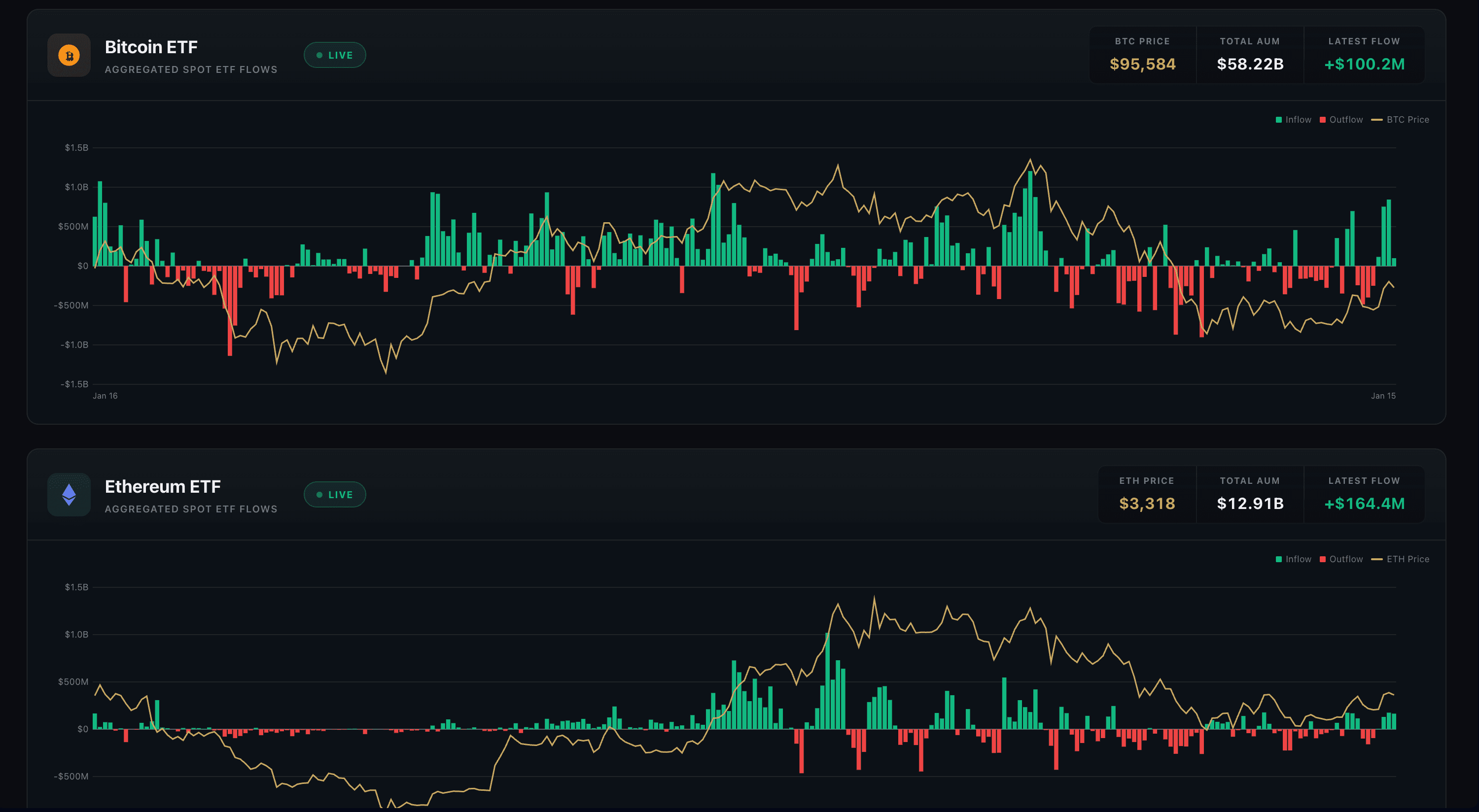

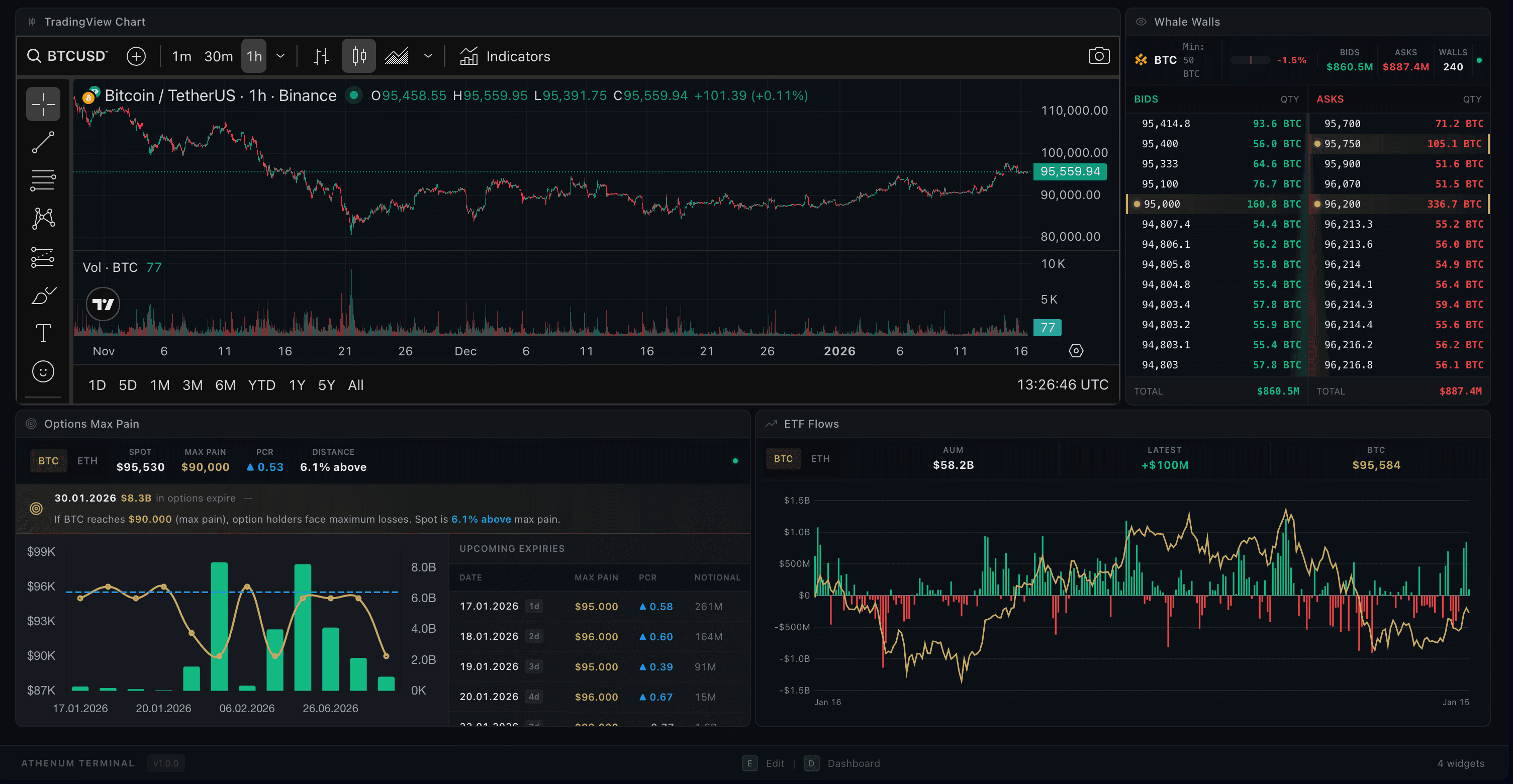

The Terminal is your fully customizable trading workspace. Drag-and-drop widgets to build your perfect layout with charts, orderbooks, whale walls, and more - all synced to your selected trading pair.

Drag & Drop Widgets

Add, remove, resize and position 6 different widget types: Chart, Order Book, Whale Walls, Trade Feed, ETF Flows, and Options Max Pain.

Layout Templates

Choose from 8 predefined layouts or create your own custom workspace and save it for later.

Symbol Sync

All widgets automatically sync to your selected trading pair - change once, update everywhere.

Keyboard Shortcuts

Press E for Edit mode to customize, D to return to Dashboard, Esc to go back.

How It Works

Press E to enter Edit mode and customize your layout

Click the + button or drag widgets from the sidebar to add them

Resize widgets by dragging their edges, move them by dragging the header

Press D to lock your layout and return to Dashboard view

Pro Tips

- Use the Scalping template for fast orderbook-focused trading

- The Whale Watching template combines whale walls across all exchanges

- Save your custom layout - it persists across sessions